Banking as a Service is used by the likes of Chime, Monzo, and so many more online banks and financial service providers.

So, what exactly is Banking as a Service (BaaS)?

Well, it’s the provision of complete banking processes as a service using an existing licensed bank’s secure and regulated infrastructure, with modern API-driven platforms from a specialist provider. These providers partner with those banks, and then BaaS lets almost any brand to embed financial services into their customer experience. And that might sound complicated - but it doesn’t have to be. Here to give you a run-down of BaaS is 11:FS Head of Ventures Simon Taylor.

Showing posts with label online banking. Show all posts

Showing posts with label online banking. Show all posts

Wednesday, 10 February 2021

Thursday, 12 January 2017

Weird bank security questions? Try these

"Often, security questions on websites aren't as difficult as security researchers would like.

An Indian bank may have addressed that issue, but it reportedly took a weird route to get there.

Journalist Rohin Dharmakumar was greeted by some very strange questions when registering with the State Bank of India."

READ MORE>>

Journalist Rohin Dharmakumar was greeted by some very strange questions when registering with the State Bank of India."

READ MORE>>

Labels:

bank security,

banks,

online banking,

technology

Monday, 22 August 2016

Digital Banking - Some banks just can't get it right

By Stanley Epstein - Principal Associate - Citadel Advantage Ltd -

I really am a really big fan of digital banking. Banking digitally is a positive change from the way banking and banking transactions were carried out in the past.

I really like the way it has changed my life for the better.

I like the way it has given me a new freedom to do my banking when I want to, where I want to and to a large degree how I want to.

There is something empowering in being able to attend to virtually all your banking needs from the comfort of your own office. A massive plus is that you have all the other relative information that you may need close at hand; you can look things up, you can check things, and you can interact with your bank from a “strongpoint”, namely from your own desk.

A particular highlight of digital banking is that there are no queues, no surly or indifferent staff, and the fantastic ability to do my banking at 1.00am if I so choose.

I also like the little extras that I didn’t expect and that have now become a nice part of my new digital arrangement with my bank and how I manage my affairs. Extras like friendly little reminders or comments that arrive comfortingly on my mobile telling me I am close to my limit or confirming a credit card transaction.

Of course, all of this comes at a price and it somehow rankles that I am to pay a fee for every little thing that I do. After all, I am doing the bank’s work by entering my own transactions, and feel that to pay for this privilege is a bit of a cheek. However, the question of bank fees is another issue. Everything else aside, I would say that I am pretty satisfied with this new digital way of doing things.

That said I have a couple of bones to pick with my own bank when it comes to some failings in this new digital world. The name of my bank will remain anonymous. They know who they are, and hopefully someone from my own bank will read this and take note. I am sure that many other banks will recognize some of the problems that I list below too, and that they too, will take action.

- Bank statements (digital on-line version). Ever since I can remember, bank statements displayed on-line, start with the first or earliest transaction, displayed at the top of the screen and subsequent transactions are shown below each other in date order. So it was with my bank for all on-line accounts (cheque, foreign exchange, investments, mortgage). At least, it was so, until about a month ago when for reasons unknown, the online cheque account statement began to appear backwards! By backwards, I mean that the latest transaction appeared at the top of the page with preceding transactions slowly being pushed down as new ones appeared. It would have been nice if the bank had bothered to tell its clients of this change, but that was not to be. From what I hear from other clients of the bank there was massive confusion among customers if not downright anger. Not a clever move.

- Terminals. As many banks have done, my local bank branch has dispensed with tellers. The lobby, as you enter the bank proper, has an impressive array of terminals, including ATM’S, where clients who still wish (or need?) to have a branch “experience” can transact their business. As with any system, there are many occasions that a transaction cannot be completed for any number of reasons. When this happens, the appropriate reason should be stated on the terminal so that the client is aware of what the real problem is. Giving a stock answer that “this transaction could not be completed”, is simply not good enough. It can easily lead to panic attacks (best case) or even heart attacks (worst case) among some bank clients. Could the transaction have failed because my balance is insufficient (‘OMG what has gone wrong with my finances?’) or is it a system problem (irritating, but I’ll live)? Why not add an extra line and tell the customer why the transaction could not be completed, like “your balance is insufficient”, or “there was a system problem” or perhaps “SNAFU” for this one would be even better?

- Cash dispensing at ATM’s. Yes, even in this digital age, there is still a need for some cash. Unfortunately my bank believes that cash withdrawals mean dispensing the largest denomination banknotes possible. Giving your customer the largest denomination notes possible, is not a service, it’s a burden. Cash generally is used only for small transactions, and a client with no human teller to go to, is really in a bind. If the bank won’t allow denomination choice at the ATM at least offer a change machine!

Labels:

banking,

digital banking,

online banking,

technology

Wednesday, 20 April 2016

Which Banking Channel Do Consumers Want More?

From The Financial Brand -

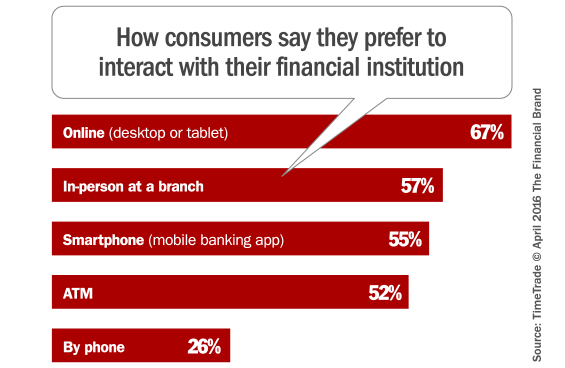

Consumers today still crave one-to-one attention from their banking providers, and have a strong preference for in-person assistance when making major financial decisions such as first-home mortgages. That’s according to a study from TimeTrade.

In their “State of Retail Banking 2016 – Consumer Survey,” research findings reveal that all ages — but particularly younger generations — say they value the option to visit an actual, physical branch. Both Millennials and Gen Z express a more intense preference for in-person discussions than other generational segments. When it comes to important financial issues, they are among the most willing to visit a bank or credit union branch for advice.

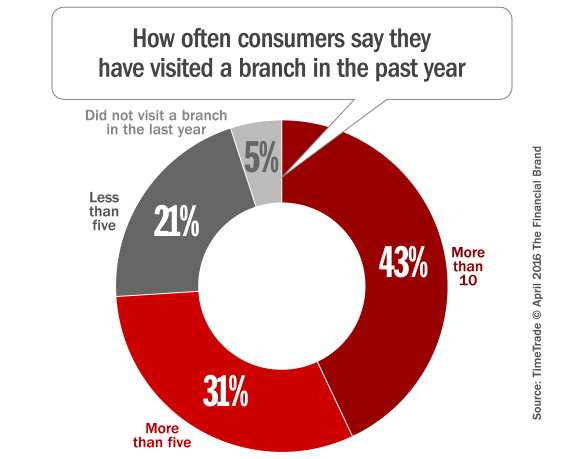

The TimeTrade survey, which encompassed over 2,000 participants, found that nearly half of consumers look to visit a branch, and are more keen to do so when they have bigger banking questions. 43% of respondents report visiting their bank branch more than ten times a year, with the average consumer saying they visited their bank branch an average of roughly six times per year.

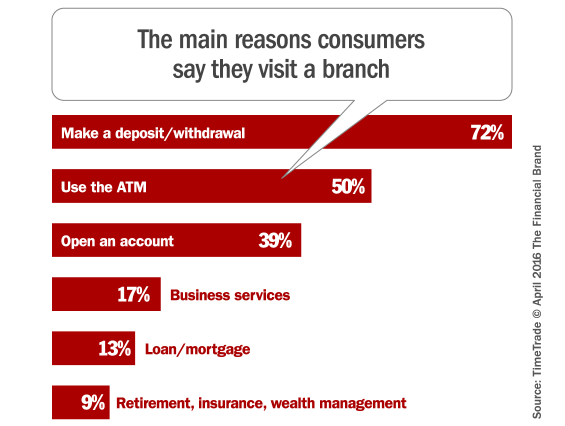

When visiting a branch, 78% said one of the reasons they came in person was that they required assistance from a specialist… perhaps because other digital and self-service channels failed?

( Read More: Banks Frustrate Consumers Who Want a More Personal Experience )

TimeTrade says the data indicates that in-person meetings are still a priority, especially when high-value services are involved. However, just because consumers are willing to drive to a branch doesn’t mean they will be patient when they get there. 64% of consumers say they are willing to wait less than ten minutes to be helped.

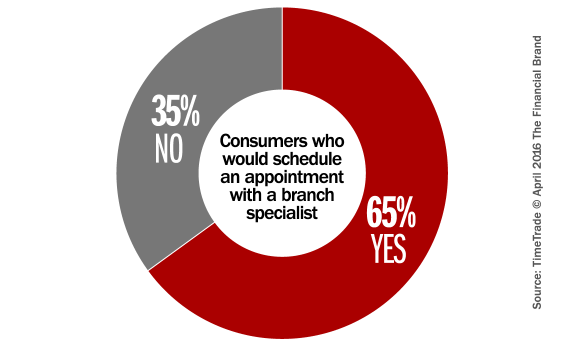

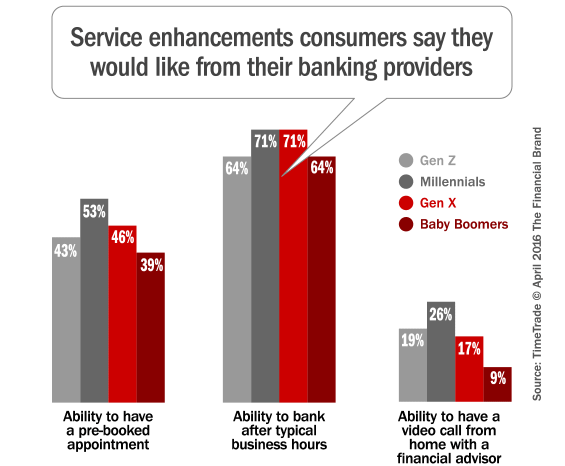

One way that banks can provide people with a simpler and more convenient service is by offering them the ability to pre-book appointments. 46% of respondents say they would like their bank to offer this option, and 65% overall are receptive to the idea.

Despite industry buzz, consumers seem — for the most part — indifferent about café-style branches, with the majority of respondents in the TimeTrade study saying it has no influence on their decision of where they bank. They couldn’t care less about coffee and wifi, so they say.

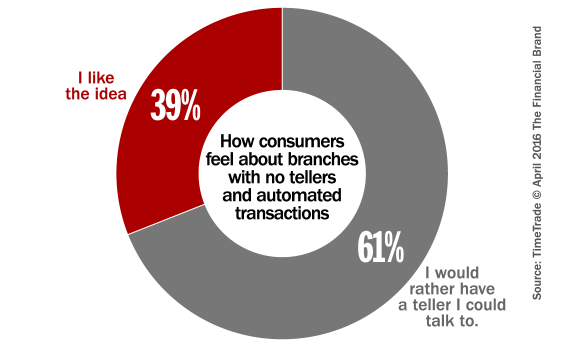

Consumers are also reluctant to embrace a fully-automated branch model. When banking consumers were asked how they felt about branches with no tellers and automated transactions, more than half said they would prefer the option of being able to talk to a teller. Still… there are quite a few consumers who seem more than willing to consider going branchless.

Respondents in the study also expressed apprehension about automation occurring more generally in the banking industry, overwhelmingly saying that — when there’s a need — they would prefer face-to-face assistance from actual people rather than from options like online/remote tellers.

Gary Ambrosino, CEO of TimeTrade, says today’s consumers have the same “on-demand” digital expectations when banking as they do when interacting with retail, travel and other brands. “At the same time, the data tell us that people still want a face-to-face experience when making big financial commitments — not strictly automated online services — and they expect these services with minimal wait-time,” explains Ambrosino.

“In banking, personalization equals trust,” says Ambrosino. “Smart banks are positioning themselves to build trust — and get more business — by personalizing banking experiences.”

This study exposes the mounting tension between old and new delivery channels: traditional branches vs. digital self-service. Are consumers really ready to ditch bricks for clicks?

Consumers today still crave one-to-one attention from their banking providers, and have a strong preference for in-person assistance when making major financial decisions such as first-home mortgages. That’s according to a study from TimeTrade.

In their “State of Retail Banking 2016 – Consumer Survey,” research findings reveal that all ages — but particularly younger generations — say they value the option to visit an actual, physical branch. Both Millennials and Gen Z express a more intense preference for in-person discussions than other generational segments. When it comes to important financial issues, they are among the most willing to visit a bank or credit union branch for advice.

The TimeTrade survey, which encompassed over 2,000 participants, found that nearly half of consumers look to visit a branch, and are more keen to do so when they have bigger banking questions. 43% of respondents report visiting their bank branch more than ten times a year, with the average consumer saying they visited their bank branch an average of roughly six times per year.

When visiting a branch, 78% said one of the reasons they came in person was that they required assistance from a specialist… perhaps because other digital and self-service channels failed?

( Read More: Banks Frustrate Consumers Who Want a More Personal Experience )

TimeTrade says the data indicates that in-person meetings are still a priority, especially when high-value services are involved. However, just because consumers are willing to drive to a branch doesn’t mean they will be patient when they get there. 64% of consumers say they are willing to wait less than ten minutes to be helped.

One way that banks can provide people with a simpler and more convenient service is by offering them the ability to pre-book appointments. 46% of respondents say they would like their bank to offer this option, and 65% overall are receptive to the idea.

Despite industry buzz, consumers seem — for the most part — indifferent about café-style branches, with the majority of respondents in the TimeTrade study saying it has no influence on their decision of where they bank. They couldn’t care less about coffee and wifi, so they say.

Consumers are also reluctant to embrace a fully-automated branch model. When banking consumers were asked how they felt about branches with no tellers and automated transactions, more than half said they would prefer the option of being able to talk to a teller. Still… there are quite a few consumers who seem more than willing to consider going branchless.

Respondents in the study also expressed apprehension about automation occurring more generally in the banking industry, overwhelmingly saying that — when there’s a need — they would prefer face-to-face assistance from actual people rather than from options like online/remote tellers.

Gary Ambrosino, CEO of TimeTrade, says today’s consumers have the same “on-demand” digital expectations when banking as they do when interacting with retail, travel and other brands. “At the same time, the data tell us that people still want a face-to-face experience when making big financial commitments — not strictly automated online services — and they expect these services with minimal wait-time,” explains Ambrosino.

“In banking, personalization equals trust,” says Ambrosino. “Smart banks are positioning themselves to build trust — and get more business — by personalizing banking experiences.”

Labels:

ATM,

bank branch,

banking,

online banking,

smartphone

Friday, 7 August 2015

China Curbs Online Payment in Fresh Blow to Internet Finance

“China plans to tighten regulations governing the nation’s 270 online-payment firms including Alibaba Group Holding Ltd.’s finance arm, dealing another blow to the booming business of Internet finance.

Under draft rules published on July 31, the central bank will limit the amount an individual can pay online to 5,000 yuan ($805) per day through third-party payment accounts, unless the customer’s identity can be verified by a security token and electronic signature. The People’s Bank of China is seeking public feedback by Aug. 28.”

Read more>>

Labels:

bank regulation,

China,

online banking,

payments

Thursday, 15 January 2015

Understanding Digital Banking

By Stanley Epstein - Principal Associate, Citadel Advantage -

The term ‘Digital Banking’ is, to my mind, one of the most

miss-understood concepts in the financial world today. Ask any group of 21st

century bankers and you will get more definitions than there are member of the

group. And this confusion of definition is one of the reasons why there a lack

of fire and enthusiasm for the whole idea.

Many simply see Digital Banking as mobile banking or on-line

banking. They see it as an add-on to existing and traditional banking services.

All of these are too narrow focused. They fail to see the big picture.

How do I define “Digital Banking”?

Well, I have agonized over this for a while now, in part

because I have been seeking a simple, succinct turn of phrase, ten or twelve

words crafted into a killer definition. But even this eludes me.

My best shot at this is;

Digital Banking is the application of technology to ensure

seamless end-to-end (STP in the ‘old’ jargon) processing of banking

transactions/operations; initiated by the client, ensuring maximum utility; to

the client in terms of availability, usefulness and cost; to the bank in terms

of reduced operating costs, zero errors and enhanced services.

Just for a moment I would like to expand on the benefits, to

both the bank and the client, just to try to illustrate a larger reality, the

way that I see digital banking.

Benefits to the bank:

- Lower operating costs through;

- the elimination of costly

back-office processing operations,

-

fewer (or ideally no)

errors,

-

smaller branch footprint

(the typical branch can become a kiosk affair, providing technology interfaces

for the client to use plus the ability to deal with banking specialists via a

video link) – a minimum number of actual staff will be required.

-

concentrating

banking/business specialists in a single centre, who are then available to

clients via a technology link (either on their mobile, pc or via a kiosk

branch).

Operating cost savings of between

20% to 40% could be achieved this way, according to industry experts. Cutting

costs has the opposite effect on profits – they go up.

·

- Dumping legacy systems;

-

Make no mistake - one of

the biggest drawbacks to going ‘Digital’ is this irrational clinging to legacy

systems (developed in the 1960s and 1970s) that hold progress back. Banks plead

the huge cost of making the change. They are wrong. The ultimate costs of not

making the change are far greater.

Benefits to the customer:

- Improved services and product offerings;

-

24/7 bank services and

availability through your mobile, pc or kiosk branch,

-

‘smart banking’

applications that allow ALL transactions to be completed from the device of

your choice, from beginning to end (with clear instructions and fail safe

mechanisms),

-

access to a FULL range of

services (savings, investments, insurance, loans, mortgages, foreign currency,

etc.),

-

new useful client services

such as warnings, notifications, budgeting, expenditure analyses, savings

programs, calculators (you name it – the range is endless),

- Lower charges (and therefore cheaper banking),

- Banking that meets the client’s needs (not the banks).

Of course with all this data available banks should not

hesitate to follow up on what their client is doing or looking at – by e-mail,

on-line chat, personal phone call. Just like the popular hotel grading system ‘Trip

Adviser’ does today. If you’ve been checking out hotels – they follow up in

days with a ‘Are you still interested in hotels in ….?’

However, somewhere along the way the concept is just simply

getting lost to many bankers. To put it in simple terms, after a promising

start, a digital application for a banking product or service comes crashing

out of the digital world, spiraling down as just another piece of paper to be

handled in just the same way as it has been done in the past. The illusion

vanishes; the bubble bursts; the concept is dead. And we remain trapped in the

same old inefficient, disjointed and highly expensive manual processing routine

of the past.

Some banks are getting it right though and for those still

on the shelf it is going to be one hell of an uphill struggle to catch up when

the penny (or the pound) finally drops.

To my mind the concept of the ‘Digital Bank’ is vibrant,

alive and exciting. It points the way to a future where banks can really add

value and where customers can secure huge benefits in terms of bank products

and services that are really, really useful.

Subscribe to:

Comments (Atom)