Wednesday, 27 August 2014

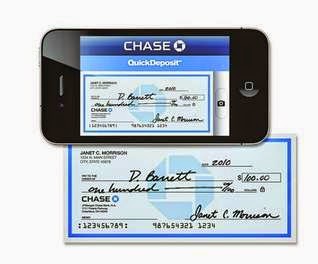

News Story Highlights Mobile Deposit Anxiety

From Bank Innovation

“A recent report from Mitek and RemoteDepositCapture.com found that 80% of banks experienced no losses from remote deposite capture.

That’s zero. Zilch. Nada.

But fears over remote deposit capture remain among consumers, as evidenced by this new story from WDTN in Dayton, Ohio. A local woman deposited a two-year-old check that had previously been deposited, and it was accepted.

The check recipient is a PNC customer. The check was written on a Citizens Bank account.

If you keep two-year-old checks around, this sort of thing will happen. This can be an inconvenience for the check recipient and check writer, but otherwise this should not be overly alarming. Checks are ranked according to risk, and the check in question was under $200 — a low-risk check that, for the sake of convenience, is generally deposited quickly. The funds may take up to several days to clear and become usable by the recipient, which is also a risk management measure.”

read more >>

Labels:

banks,

innovation,

mobile banking,

remote deposit capture,

risk